Bookkeeping Essentials For Construction Companies

The construction-specific integrations you need will vary on your line of work. However, some popular ones I like to see include Autodesk, Bluebeam, PlanGrid, Lendflow, and at least one time-tracking software like ClockShark or TimeClock Plus. Any general-purpose accounting software has been excluded, as it didn’t meet my core evaluation requirements. If your construction business is growing quickly and you’re finding https://www.inkl.com/news/the-significance-of-construction-bookkeeping-for-streamlining-projects it hard to keep everyone on the same page, then CMiC is the software I recommend. Its collaboration suite keeps all of your project bids, schedules, and summary data in one place so that nothing gets lost.

Use project-specific cost-tracking

- Bookkeepers help identify areas where cost-saving measures can be implemented or where additional resources may be needed.

- Look for accounting software that either auto-generates these reports or guides you through doing so in a few clicks.

- We picked it for features like multi-company and multicurrency support and intercompany accounting, making it versatile for a wide range of business sizes and types.

- By leveraging these services, businesses can focus on delivering quality projects while maintaining financial transparency and stability.

- It’s easiest to meet nearly every need on your list when you consider several potential accounting platforms instead of only one.

- A construction bookkeeper manages financial records, tracks job costs, processes payroll, handles invoicing, and ensures tax compliance.

All our picks for the best accounting software for contractors offer free trials of at least 14 days. Sign up for these trials to test your potential platforms for yourself before committing. This way, you get a hands-on sense of whether the platform is right for your business.

Easy-to-Use Accounting & Bookkeeping Features

The software integrates easily with QuickBooks Online or Xero (both of which are great accounting picks), but both add an additional monthly fee. Plus, Buildertrend starts at an affordable $99 a month—but for the first two months only. After that, your price goes up to $299 a month (or $499 a month if you started with the pricier plan). We invest in deep research to help our audience make better software purchasing decisions. We’ve tested more than 2,000 tools for different finance and accounting use cases and written over 1,000 comprehensive software reviews. Learn how we stay transparent & our accounting software for contractors review methodology.

Organize Your Books With Bookkeeping Services

This includes everything from materials and equipment to subcontractor payments and travel expenses. Accurately tracking these expenses is essential for maintaining a healthy bottom line. General contractors should not only focus on current projects but also plan for future growth. Setting financial goals and creating a budget that supports business expansion is key to long-term success. By working with a professional accounting service, you can develop a growth strategy based on sound financial planning and construction bookkeeping principles.

Managing Payroll and Expenses

Simon Litt is the construction bookkeeping editor of The CFO Club, specializing in covering a range of financial topics. His career has seen him focus on both personal and corporate finance for digital publications, public companies, and digital media brands across the globe. The practice of retainage, aka retention, has a tremendous impact on the construction industry. I am reviewing a schedule of value for a project that does not have a % of the project total assigned to project closeout.

This enables businesses to monitor profitability on a project-by-project basis, identify cost overruns early, and make data-driven decisions to optimize resource allocation. Most businesses simply record the cost of the products sold, but construction companies are quite different. Each job incurs direct and indirect costs that may fall into a wide range of categories. It’s essential that contractors have an effective method for keeping track of income and expenses, and for reconciling every transaction.

Subcontractor management

- Professional bookkeepers implement systems that automate routine tasks such as expense tracking, invoicing, and report generation.

- Foundation Software is ideal for contractors looking for a platform that offers both construction-specific features and strong payroll capabilities.

- For the construction industry, though, there are far too many quirks and details that most of the off-the-shelf tools can’t accommodate.

- Real-time financial reporting gives you a clear view of your projects’ profitability.

- Regular account reconciliation helps catch errors, prevent fraud, and ensure accurate financial reporting.

- Although one negative review shouldn’t sink the ship for any vendor you’re considering, all feedback is worth keeping in mind.

It requires an understanding of unique accounting principles and regulations specific to the industry. One of the most important steps in construction accounting is keeping personal and business finances separate. Opening a dedicated business account helps avoid confusion, makes tax reporting easier, and ensures that you have accurate financial records for your business.

- Not all standard accounting software has the features you need for the construction industry.

- COINS is one of the most fully featured accounting software options for contractors and construction teams.

- Use construction-specific accounting software to manage invoicing, payroll, and taxes.

- Change orders are made easy where you can manage all the moving parts of the change order to keep everyone in the loop on new requests.

- Expert bookkeepers ensure that all project-related expenses are accounted for correctly and allocated to specific jobs.

This robust feature set — as well as training on how to use it — makes Foundation a good fit for a wide range of construction companies. We believe everyone should be able to make financial decisions with confidence. While office professionals in B2B industries may have the time and patience to deal with expansive tech stacks, contractors and construction teams usually don’t. When searching, try to strike a balance between user-friendliness and functionality.

Nonprofit Bookkeeping Guide for Accurate Records

Following generally accepted accounting principles helps prevent issues with donors and audited financial statements. By maintaining these three focus areas, your nonprofit accounting system helps build donor trust while ensuring compliance with all requirements. This comprehensive approach to donor management through proper nonprofit accounting practices helps create sustainable funding relationships that support your organization’s long-term success. Key components include a well-structured chart of accounts, fund accounting, accurate tracking of donor contributions and grants, and regular financial reporting.

- In this guide, we’ll cover the responsibilities and skills of nonprofit bookkeepers, and we’ve included a job description template to help you get started.

- A generous car dealership gives you a vehicle for free, but that doesn’t mean it wasn’t a transaction!

- By managing daily transactions, processing payroll, and assisting with budgeting, bookkeepers allow leadership to focus on strategic growth and mission fulfillment.

- Six months is even better, but a reserve of less than one month can cause potential cash flow problems.

- Nonprofits have daily operating costs similar to other organizations, like salaries, supplies, utilities, etc.

- Nonprofit accounting involves complex financial management strategies, compliance oversight, and strategic planning.

Nonprofit Accounting Terms

Nonprofits should adhere to Generally Accepted Accounting Principles (GAAP) or the Financial Reporting Standards (FRS) specific to their country. These standards provide guidelines for financial reporting, including the presentation of financial statements and the recognition of revenue and expenses. While for-profit organizations use their accounting practices to help them turn a profit and pay dividends to their investors, nonprofits aren’t allowed to do this by definition. Advancements in technology, particularly in areas of cloud-based systems and automated software, can bring increased efficiency to nonprofit accounting.

What is Bookkeeping for Nonprofits

Proper bookkeeping tells you exactly where each dollar goes and proves that funds advance your cause. In this section, you’ll learn why disciplined record‑keeping is as vital as a compelling vision. Bookkeeping for nonprofits deserves the same rigor as any corporate ledger, yet it must also respect the purpose that drives every donation.

Accounting

For-profit bookkeeping, on the other hand, emphasizes profitability and investor returns. Nonprofit bookkeepers must be familiar with specific regulations, such as IRS Form 990, which is required for tax-exempt status. AccuFund is an excellent resource for nonprofits looking for a reliable financial management tool. As your nonprofit grows and steps out into more complicated financial projects, AccuFund lets https://namesbluff.com/everything-you-should-know-about-accounting-services-for-nonprofit-organizations/ you purchase tools that fit your organization’s needs.

- Implementing robust financial controls and conducting internal audits helps identify and mitigate potential risks, errors, or fraud.

- Likewise, regular reporting builds donor trust and often leads to continued support.

- As a bookkeeper, it may be necessary to meet with your nonprofit’s accountant weekly, monthly, quarterly, and yearly.

- This way, all of your data will be consistent, and it’ll be easier to review your funding model and make adjustments to increase your organization’s financial stability.

- Use reporting tools within the software to generate comprehensive financial reports for donors and stakeholders.

Core Nonprofit Bookkeeping Duties

To learn more about purchase orders and the numberings involved, check out our post on What is a Purchase Order Number. He is registered with the IRS as an Enrolled Agent and specializes in 501(c)(3) and other tax exemption issues. Yes, except for churches and very small organizations with gross receipts under $50,000, which may file the simple Form 990‑N. Generate the three core statements each month and share them with the executive director and finance committee. Explore how our team can lighten your administrative load and strengthen donor confidence.

- Open communication through transparent financial records builds donor confidence.

- It helps ensure donor restrictions are honored and funds are used as intended.

- Avoiding these pitfalls lays out a smoother journey toward financial transparency.

- This process helps identify and correct discrepancies, preventing potential issues down the line.

- This preparation helps your organization maintain strong financial management even when key personnel changes occur.

The COA organizes all the accounts that a non profit uses to track its financial transactions, ensuring that each entry is categorized correctly. Restricted funds are donations or grants given for a specific purpose or project and must be used accordingly. Unrestricted funds can be used at the nonprofit’s discretion for any operational needs, providing greater flexibility in managing resources. The treasurer works closely with the bookkeeper to maintain accurate financial records. A person in this position will oversee budgeting, reporting, and will also take care of the regulations and policies of the nonprofit.

The average yearly salary of a nonprofit bookkeeper in the US is $62,587, depending on experience and the organization’s size. Fortunately, nonprofit professionals don’t have to worry about your financial information if you choose FreshBooks. It’s also important to recognize that accounting services for nonprofit organizations bookkeeping is not a part-time job.

These programs can automate tasks, streamline workflows, and generate detailed reports for revenue and expenses. Accurate bookkeeping ensures the organization has the necessary documentation to support its tax-exempt status. Bookkeeping also helps maintain a clear separation between program service activities that fulfill the nonprofit’s mission and unrelated business activities that may generate taxable income. Meticulous tracking of restricted funds is also essential as is proper allocation of expenses to demonstrate responsible use of funds.

DAX График индекса DAX 40 TradingView

Weighted Average Shares Outstanding Formula + Calculator

Authorized shares, which are also known as authorized capital or approved stock, are the maximum number of shares of stock that a company’s charter or articles of incorporation permit it to issue. The resulting number shows the total number of shares held by all market participants, including institutional average common shares outstanding investors, insiders, and the general public. Outstanding shares are a financial metric that indicates the total number of shares of a company’s stock held by its shareholders. The number of outstanding shares impacts a company’s liquidity and ability to buy back shares. Some shareholders own a significant portion of outstanding shares and have more control over the company’s decisions and outcomes.

What Country Produces the Most Corn and Its Economic Impact?

To add a transaction, select the date of the Bakery Accounting transaction (must be unique from all other transaction dates), select Increase or Decrease, and enter the number of shares transacted. A Data Record is a set of calculator entries that are stored in your web browser’s Local Storage. If a Data Record is currently selected in the „Data“ tab, this line will list the name you gave to that data record.

- Floating shares are a key indicator of a company’s liquidity and market activity, as they show how easily shares can be bought and sold in the market.

- The Securities and Exchange Commission (SEC) mandates disclosure of buyback plans to prevent market manipulation.

- These actions include the issuance of new stock, stock dividends, and stock splits.

- For each interval, multiply the number of shares by the fraction of the period it represents, and sum these weighted segments to get the WASO.

- EPS takes on added significance when factoring in non-recurring items like asset sales or restructuring costs, which can skew net income.

- The weighted average provides a more precise reflection of the company’s share structure over time, taking into account not just the number of shares but also the duration they’ve been outstanding.

- Since the denominator is greater in the basic EPS, the diluted EPS is always less than the basic EPS from the higher share count.

How Stock Buybacks and Issuances Impact Shares Outstanding

Floating stock is calculated by taking outstanding shares and subtracting restricted shares. Restricted stock are shares that are owned by company insiders, employees and key shareholders that are under temporary restriction, and therefore cannot be traded. A company generally embarks on a reverse split or share consolidation to bring its share price into the minimum range necessary to satisfy exchange listing requirements. While the lower number of outstanding shares often hampers QuickBooks liquidity, it could also deter short sellers since it becomes more difficult to borrow shares for short sales. Let’s break down the concept of shares outstanding with some real-life examples. In the case of KLX Inc., the company had 5.0 million authorized common stock and 1.0 million authorized preferred stock, but only 3.5 million common stock and 0.7 million preferred stock were issued.

Calculator Title:

The Management’s Discussion and Analysis (MD&A) section often explains equity-related decisions, such as stock splits or repurchase programs, offering insight into the company’s strategy. For instance, a company might disclose repurchasing 1 million shares to enhance shareholder value, reducing outstanding shares from 50 million to 49 million. Since we now have the beginning and ending number of common shares outstanding, the next step is to calculate the weighted average shares outstanding.

- A company may have 100 million shares outstanding, but if 95 million of these shares are held by insiders and institutions, the float of only five million may constrain the stock’s liquidity.

- This distinction is critical for ensuring the accuracy of the EPS calculation, as it directly impacts the denominator in the equation.

- For example, a 10% stock dividend gives a shareholder with 100 shares an additional 10 shares.

- The final step involves synthesizing the data and adjustments into a single figure that reflects the company’s share dynamics over the reporting period.

- It reveals the number of shares outstanding and the factors influencing equity changes, such as new share issuances, buybacks, dividends, and retained profits or losses.

- Certain corporate actions, like stock splits, share issuances, or buybacks, necessitate adjustments in the WASO calculation.

- The reason is that these shares have been issued on the last day of the year and have not been outstanding during the year 2022.

There are also considerations to a company’s outstanding shares if they’re blue chips. The weighted average number of shares is determined by taking the number of outstanding shares and multiplying it by the percentage of the reporting period for which that number applies for each period. In other words, the formula takes the number of shares outstanding during each month weighted by the number of months that those shares were outstanding.

Liabilities vs Expenses: What’s the Difference?

Michelle Payne has 15 years of experience as a Certified Public Accountant with a strong background in audit, tax, and consulting services. She has more than five years of experience working with non-profit organizations in a finance capacity. Keep up with Michelle’s CPA career — and ultramarathoning endeavors — on LinkedIn. Some loans are acquired to what are retained earnings purchase new assets, like tools or vehicles that help a small business operate and grow. Principle and interest payable refer to any payments due regarding the mortgage or loan payment.

We charge a monthly fee based on your business type

Examples of liability accounts that display on the Balance Sheet include Accounts Payable, Sales Tax Payable, Payroll Liabilities, and Notes Payable. Fixed assets, or non-current assets, are tangible assets with a life span of at least one year and usually longer. Intangible assets are things that represent money or value, such as accounts receivables, patents, contracts, and certificates of deposit (CDs). Running a business can be confusing at times, and especially if there’s lots of new accounting jargon that you’re not used to. Our ongoing series of accountancy FAQ articles helps small business Online Bookkeeping owners understand the accounts terminology they encounter. Accrued liabilities only exist when using an accrual method of accounting.

What Is an Accrued Expense?

- Although they aren’t distributed until January, there is still one full week of expenses for December.

- An accrued liability is an expense that a business has incurred but not yet paid for.

- On the other hand, liabilities represent the debts or obligations that a company owes to external parties, such as loans, accounts payable, or accrued expenses.

- The credit balance at month or year end is what flows through to the company’s balance sheet.

- It’s like a shiny metal unicorn that whisks you away to your financial dreams.

It invoices the restaurant for the purchase to streamline the drop-off and make paying easier for the restaurant. Expenses are typically recurring payments that are necessary to run a business. You can calculate your total liabilities by adding your short-term and long-term debts. Keep in mind your probable contingent liabilities are a best estimate and make note that the actual number may vary.

- At the same time, ignoring liabilities until they’re due can lead to poor cash flow management and planning—both of which lead to inaccurate budgeting and forecasting.

- On a balance sheet, these two categories are listed separately but added together under “total liabilities” at the bottom.

- Prepaid expenses are payments made in advance for goods and services that are expected to be provided or used in the future.

- Liabilities often appear on the balance sheet, affecting the company’s assets and equity, while expenses appear on the income statement, directly impacting net income.

- Expenses are an essential component of a company’s income statement.

What is the rule of liabilities in accounting?

The insurance are expenses a liability company, however, is obligated to provide coverage in case of a covered event. This crucial distinction highlights why prepaid insurance (and all prepaid expenses) are assets, not liabilities. Confusing prepaid expenses with liabilities would misrepresent a company’s financial position. Understanding the underlying nature of these accounts is essential for accurate financial reporting. Therefore, a clear understanding that is prepaid expense a liability will allow the balance sheet to be reported correctly. Recognizing the difference between assets and liabilities enables stakeholders to make well-informed decisions based on the financial statements.

An expense represents a cost a company incurs during its operations to generate revenue. These are the resources a company consumes to create its products or deliver its services. Costs are recorded in the accounting period in which they are incurred, a concept known as the matching principle. This principle seeks to align costs with the revenues they helped produce, allowing for a clear calculation of profitability for that period.

Financial Outlays

- Unlike liabilities, which represent obligations, expenses signify the cost of resources consumed in generating income.

- Prepaid expenses expected to provide benefits beyond this timeframe are classified as non-current assets (long-term assets).

- Distinguishable expenses are technically not required, but they can be.

- If you don’t pay expenses on time, you risk vendors shutting off crucial services and mission-critical supplies.

- For example, separate presentation might be made for significant prepaid rent, insurance, or software subscriptions.

- The most common liabilities are usually the largest such as accounts payable and bonds payable.

- Furthermore, expenses are usually recurring in nature, meaning they are expected to be incurred regularly over time.

A liability is money owed in the future, while an expense is a cost incurred to help the business run smoothly and generate revenue. Current liabilities are due within a year and include costs such as payroll, accounts payable and other short-term obligations. Noncurrent liabilities are long-term debts or obligations that are due beyond a 12-month period. The balance sheet reflects business expenses by drawing down the company’s cash account and increasing accounts payable. Also, expenses are more immediate in nature and are paid on a regular basis. They are shown on a company’s monthly income statement to determine the company’s net income.

Imagine you’re running a lemonade stand and want to know if it’s profitable. You need to track your expenses, the costs of running your business. Those expenses are like the bricks that build the foundation of your financial analysis. A company uses electricity throughout a month, and the cost is an expense for that month. If the utility company sends a bill at the end of the month that is due the following month, the company has incurred an expense but has not yet paid cash. AP typically carries the largest balances because they encompass day-to-day operations.

Adjusted Trial Balance What Is It, Example, Accounting, Purpose

The adjusting entries in the example are for the accrual of $25,000 in salaries that were unpaid as of the end of July, as well as for $50,000 of earned but unbilled sales. Carbon Collective partners with financial and climate experts to ensure the accuracy of our content. Shaun Conrad is a Certified Public Accountant and CPA exam expert with a passion for teaching.

📆 Date: 22-23 Mar, 2025🕛 Time: 8:30-11:30 AM EST📍 Venue: OnlineInstructor: Dheeraj Vaidya, CFA, FRM

The adjusting entries for the first 11 months of the year 2015 have already been made. Hence, the trial balance includes all considerable adjustments, which is termed as adjustment trial balance. We get clear information from trial balance about debit entries and credit entries. But there is some more information required to adjust the trial balance. There are instances when companies end up missing out mentioning the transactions that have occurred in the bookkeeping records. The next type of adjustment is the accrual, which ensures inclusion of the future payments that the business entity is entitled to make.

How to Get a Business Credit Card for an LLC: A Complete Guide

An adjusted trial balance is prepared after adjusting entries are made and posted to the ledger. In this lesson, we will discuss what an adjusted trial balance is and illustrate how it works. When it comes to the adjustment made, the adjusted trial balance sheet is left with information that is relevant for a particular period as per the information that the business organization seeks. The adjustments made, however, are classified into different categories, which include – deferrals, accruals, missing transactions, and tax adjustments. For manual accounting processes, creating the adjusted trial balance trial balance is the finalization of the numbers for a period in time.

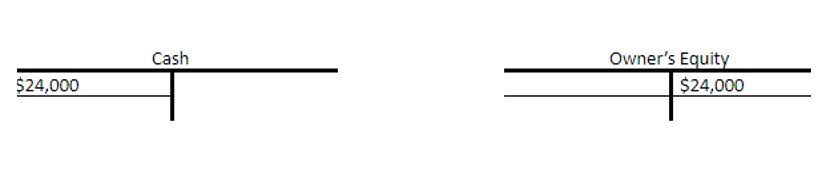

Sourcing from Mexico: Best Practices for US Businesses

Begin by listing all accounts along with their adjusted balances in a trial balance format. Next, make sure that the total debits equal the total credits, thereby confirming that the adjusted trial balance is in balance. These adjustments are made for items such as accrued revenues, accrued expenses, prepaid expenses, and unearned revenues. Adjusting entries are recorded in the general journal and then posted to the appropriate accounts in the ledger. Both the debit and credit columns are totaled at the bottom and must be equal in order to agree with the accounting equation.

- Thestatement of retained earnings is prepared second to determine theending retained earnings balance for the period.

- After recording adjusting entries, post them to the ledger accounts.

- The first thing you should do with a completed adjusted trial balance is review the most important balances and compare them against past periods.

- Presentation differences are most noticeable between the twoforms of GAAP in the Balance Sheet.

- In the above example, unrecorded liability related to unpaid salaries and unrecorded revenue amount has been included in the adjusted trial balance.

- The statement ofretained earnings is prepared before the balance sheet because theending retained earnings amount is a required element of thebalance sheet.

However, this time the ledger accounts are first updated and adjusted for the end-of-period adjusting entries, and then account balances are listed to prepare the adjusted trial balance. It is usually used by large companies where a lot of adjusting entries are prepared at the end of each HVAC Bookkeeping accounting period. Before preparing the financial statements, an adjusted trial balance is prepared to make sure total debits still equal total credits after adjusting entries have been recorded and posted.